We help you plan

Your Financial Future

Achieve your financial goals with our expert advice and personalized solutions.

Get expert financial advice for your future

We specialize in providing personalized financial planning services to help you achieve your goals and objectives to secure your financial future. Our services include the following:

• Deposit and payment products limited to: (a) basic deposit products; (b) deposit products other than basic deposit products

• Derivatives

• Debentures, stocks or bonds issued or proposed to be issued by a government

• Life products including: (a) investment life insurance products; and (b) life risk insurance products

• Interests in managed investment schemes including: (a) investor directed portfolio services

• Retirement savings accounts

• Securities

• Superannuation (standard)

• Self-managed superannuation funds

• Tax (financial) adviser

• Portfolio Review:

- Internal databases are maintained detailing client’s investments that were recommended by the licensee. This does not constitute portfolio monitoring.

- Portfolios are reviewed on a regular basis, subject to the client’s discretion.

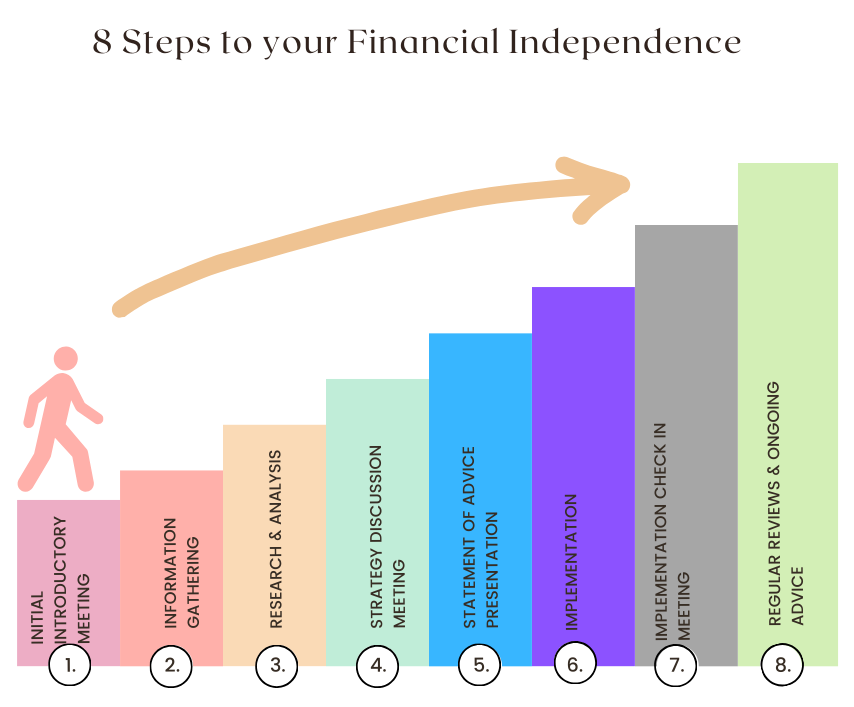

THE FINANCIAL PLANNING PROCESS

Frequently Asked Questions

How do you determine the best financial strategy for me?

We start with a detailed consultation to understand your financial situation, goals, risk tolerance, and time horizon. Based on this information, we create a customized financial plan that aligns with your objectives while optimizing tax efficiency and investment opportunities.

What is the cost of financial planning services?

Our fees vary depending on the level of service required. We offer transparent pricing, which may include flat fees, percentage-based fees on assets under management, or hourly consultation rates. We discuss all costs upfront so you know exactly what to expect.

How often should I review my financial plan?

We recommend reviewing your financial plan at least annually or whenever you experience major life changes, such as marriage, career changes, buying a home, or planning for retirement. Regular reviews ensure your financial strategy stays aligned with your evolving needs.

What is the difference between a financial planner and an accountant?

While accountants focus on tax compliance and financial reporting, financial planners take a broader approach, helping clients manage investments, retirement savings, insurance, and overall financial growth. We work closely with accountants to create a cohesive strategy that maximizes your financial well-being.